2019 – 08/26 Attention employers! You may be able to reduce the tax you owe with a valuable credit. It’s called the employer credit for family and medical leave. Among other things, to be eligible, you must have a written policy that meets certain requirements and provide at least two weeks of paid family and medical leave to full-time employees and prorated leave to part-time employees. Pay must equal at least 50% of the employee’s normal wages. The credit is a percentage of leave pay, ranging from 12.5% to 25%, and is available for wages paid after Dec. 31, 2017, and before Jan. 1, 2020. For more details: https://bit.ly/2L2TYwg

Similar Posts

IRAs Invested in Unconventional Assets

2020 – 03/03 The Government Accountability Office (GAO) has issued a report that examines the challenges associated with enforcing rules governing IRAs invested in unconventional assets. The bottom line of the report is that the IRS can do a better job informing taxpayers about noncompliance related to such assets. Unconventional IRA investments include real estate,…

IRS: Restaurants Defined

2021 – 04/09 A recent tax law provides a 100% business deduction (up from 50%) for food and beverage expenses in 2021 and 2022 as long as they’re “provided by a restaurant.” The IRS has now defined the term “restaurant” for purposes of the deduction. According to the IRS, the term “restaurant” means a business…

It’s a good time to buy business equipment and other depreciable property

There’s good news about the Section 179 depreciation deduction for business property. The election has long provided a tax windfall to businesses, enabling them to claim immediate deductions for qualified assets, instead of taking depreciation deductions over time. And it was increased and expanded by the Tax Cuts and Jobs Act (TCJA). Even better, the…

Retirement Saving Options for Your Small Business: Keep it Simple

If you’re a small business owner, you may be reluctant to set up a retirement plan because of the administrative burdens. Here are two options to consider that have far fewer requirements than traditional qualified retirement plans.

Charitable Contribution Deduction

2021 – 11/04 As we approach the end of the year, be aware that taxpayers are allowed a special charitable contribution deduction for 2021 even if they don’t itemize. Ordinarily, people who claim the standard deduction on their tax returns can’t claim a deduction for their charitable donations. But a temporary law change permits them…

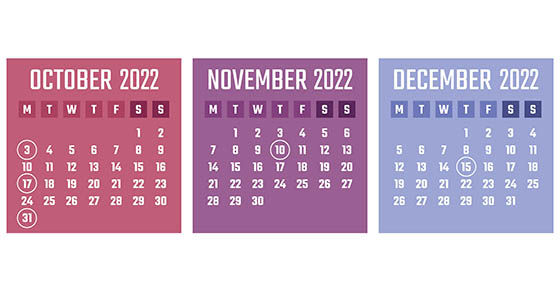

2022 Q4 tax calendar: Key deadlines for businesses and other employers

2022 – 09/19 Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the…