2022 – 08/02 The Affordable Care Act’s (ACA’s) affordability percentage for employers to avoid a shared responsibility payment (penalty) is decreasing in 2023. The ACA’s employer-shared responsibility provision requires applicable large employers to offer minimum essential coverage that’s “affordable” and that provides “minimum value” to full-time employees or potentially make an employer-shared responsibility payment to the IRS. Health insurance coverage is considered “affordable” to an employee if the lowest-cost self-only health plan is 9.5% or less of a full-time employee’s household income (indexed for inflation). The percentage for 2023 will decrease from 9.61% to 9.12%. (IRS Rev Proc 2022-34)

Similar Posts

FAQ: What are my odds of being audited?

Audit coverage rates are at low levels, the IRS has reported. According to the IRS, the audit coverage rate for individuals fell 16 percent from FY 2015 to FY 2016. The 0.7 percent audit coverage rate for individuals was the lowest coverage rate in more than a decade, the agency added. Selection Process The raw…

Numerous tax limits affecting businesses have increased for 2020

2020 – 01/27 An array of tax-related limits that affect businesses are annually indexed for inflation, and many have increased for 2020. Here are some that may be important to you and your business. Social Security tax The amount of employees’ earnings that are subject to Social Security tax is capped for 2020 at $137,700…

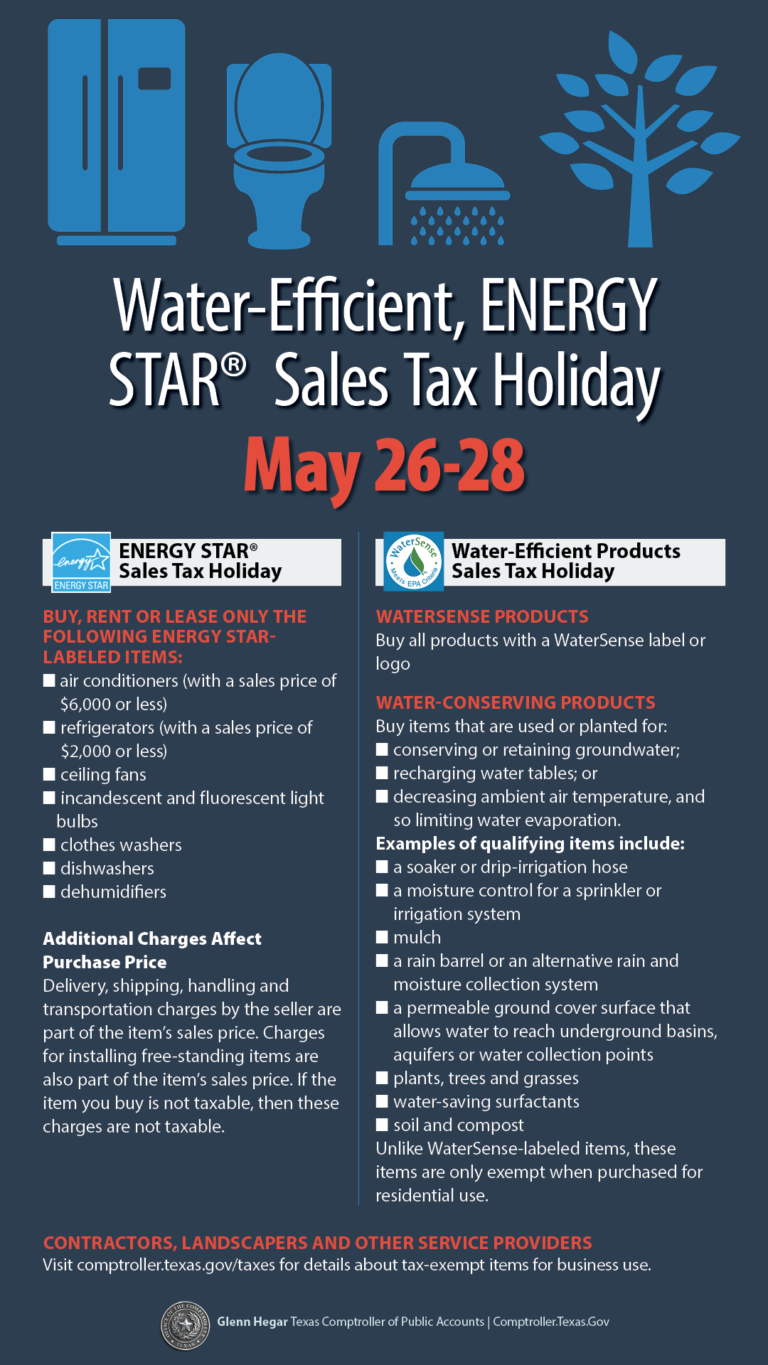

ENERGY STAR Sales Tax Holiday

You can buy certain ENERGY STAR energy-efficient products tax-free during the annual Texas ENERGY STAR Sales Tax Holiday. There is no limit on the number of qualifying items you can buy, and you do not need to give the seller an exemption certificate to buy items tax free. Click Here for more details on the…

Is an S corporation the best choice of entity for your business?

2021 – 03/22 Are you thinking about launching a business with some partners and wondering what type of entity to form? An S corporation may be the most suitable form of business for your new venture. Here’s an explanation of the reasons why. The biggest advantage of an S corporation over a partnership is that…

Get SMART when it comes to setting strategic goals

Strategic planning is key to ensuring every company’s long-term viability, and goal setting is an indispensable step toward fulfilling those plans. Unfortunately, businesses often don’t accomplish their overall strategic plans because they’re unable to fully reach the various goals necessary to get there. If this scenario sounds all too familiar, trace your goals back to…

Getting Married? How That Affects Your Taxes.

2022 – 05/20 It’s wedding season — a happy time that includes gifts, cake and endless details. Chances are, taxes are the last thing on your mind. But the IRS wants to remind you of a few important steps. Soon, you’ll be filing your first tax return as a married person and that could affect…