2021 – 08/06 Tax-related identity theft can happen if someone steals your personal information to commit tax fraud. As part of its “Boost Security Immunity” campaign, the IRS is promoting tighter security using effective tools such as multi-factor authentication. This allows a taxpayer to add another layer of protection. It can involve a security code sent to a mobile device, a personal ID number or a fingerprint, in addition to a username and password. Also recommended is the use of regularly updated anti-virus software. For more information about guarding your own identity:

Similar Posts

Qualified Business Income Deduction

2019 – 01/23 The qualified business income (QBI) deduction is beneficial, but complex and subject to limitations. There are two ways to claim the Sec. 199A QBI deduction. One involves 20% of a taxpayer’s QBI and the other uses the amount of W-2 wages paid by an employer. New IRS guidance describes how to calculate…

Reduce 2021 Tax Liability

2021 – 12/02 As 2021 comes to an end, the IRS wants to remind you of certain tasks you may want to accomplish before Dec. 31. To reduce this year’s tax liability, charitable donations must be made by year-end. In 2021, even those who don’t itemize can claim a limited $300 deduction, or $600 for…

Marginal Federal Tax Rates

2018 – 02/05 Tax rates get a closer look. The Congressional Budget Office just published a report entitled “Marginal Federal Tax Rates on Labor Income: 1962 to 2028.” The marginal tax rate is defined as “the percentage of an additional dollar of earnings that is unavailable to an individual because it is paid in [federal…

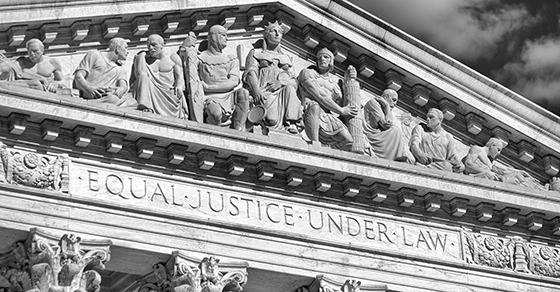

Foreign Bank and Financial Accounts

2022 – 06/22 The Supreme Court of the United States (SCOTUS) will take up a controversial issue affecting owners of certain foreign financial accounts. A holder of a foreign account worth more than $10,000 in the preceding year must file a “Report of Foreign Bank and Financial Accounts” (FBAR). For a non-willful failure to file,…

Are you eligible for an Employee Retention Credit?

2020 – 06/16 Valuable tax credits are available to employers to help mitigate the effects of the COVID-19 pandemic. But amid the chaos of the last few months, it may be hard to navigate the details of how to qualify for the credits. To help, the IRS has created a flowchart that explains the details…

IRS: Verifying Your Identification

2021 – 08/09 The next time you call the IRS, you’ll be asked to provide specific information to verify your identification. To that end, the IRS has set out the identity information a caller should have ready. Among other requirements, the caller must provide a Social Security number (SSN) and birth date, an Individual Taxpayer…